Addy AI

About Addy AI

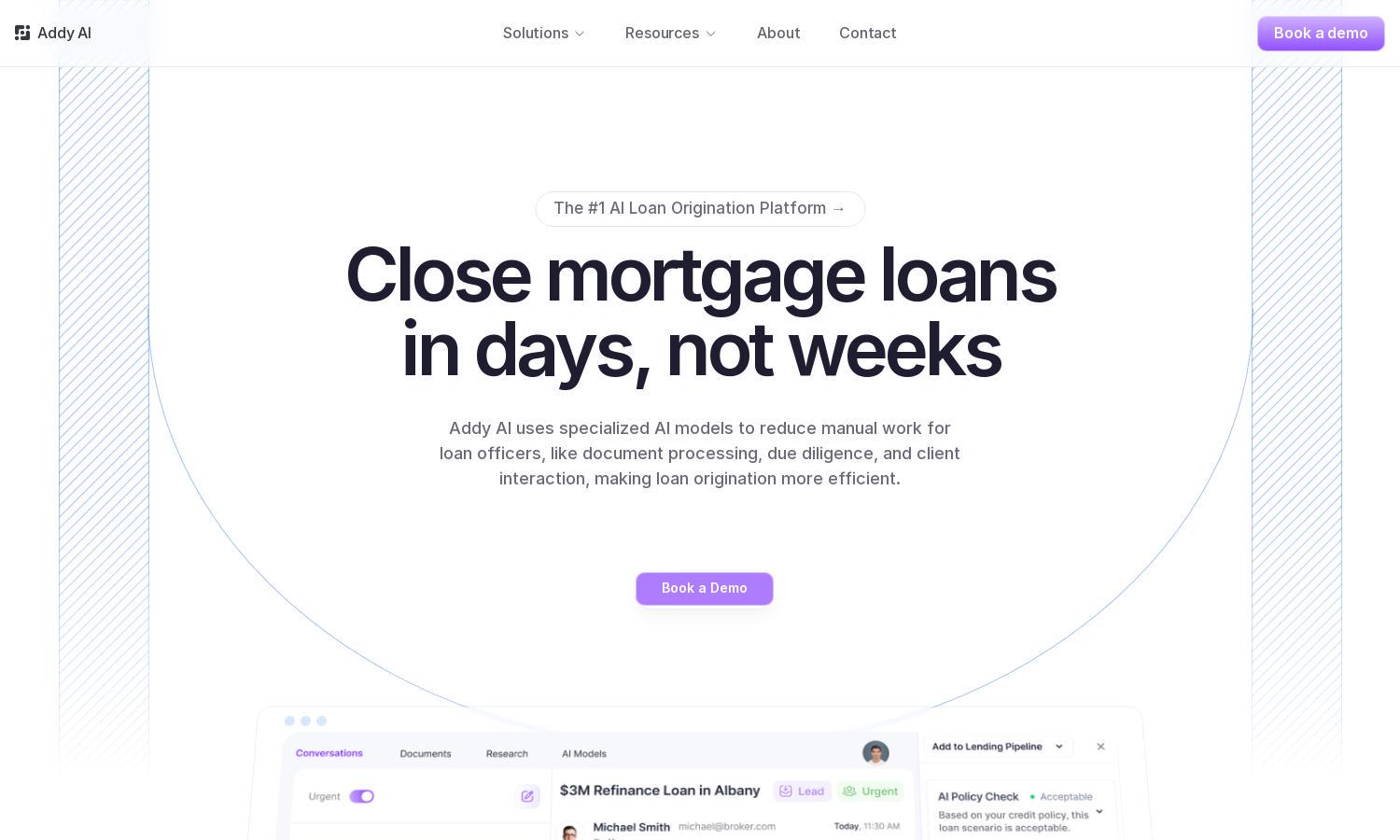

Addy AI assists mortgage lenders by automating the loan origination process with custom AI models. Designed for efficiency, it streamlines document processing and client interactions, allowing loan officers to save significant time. With its innovative technology, Addy AI provides 24/7 support, enhancing productivity in the lending industry.

Addy AI offers flexible pricing plans for mortgage lenders, from basic to advanced features. Each tier provides increasing access to AI tools that automate manual tasks, thereby improving efficiency. Users gain added value through custom models and enhanced integrations. Explore special discounts for early adopters of Addy AI.

The user interface of Addy AI is designed for simplicity and efficiency, ensuring a seamless experience for mortgage lenders. It features easy navigation, quick access to tools, and user-friendly layouts that allow loan officers to manage their workflows effortlessly. This creates an optimal environment for maximizing productivity.

How Addy AI works

Users begin by signing up on Addy AI, where they can customize AI models tailored to their mortgage lending needs. After onboarding, they access a suite of tools that automate tasks such as document processing and client follow-ups. The platform seamlessly integrates into existing systems, enhancing workflow without disrupting operations.

Key Features for Addy AI

Automated Document Processing

Addy AI's automated document processing feature revolutionizes mortgage lending. Users can quickly extract relevant data from large documents, saving time and reducing manual errors. This capability enhances the efficiency of loan officers, allowing them to focus on client interactions rather than paperwork.

Client Follow-Up Automation

With the client follow-up automation feature, Addy AI ensures timely and effective communication with borrowers and brokers. Users can train the AI to manage inquiries 24/7, improving customer satisfaction and increasing the chances of closing loans faster while reducing repetitive manual workloads.

Real-Time Loan Eligibility Assessment

Addy AI provides real-time loan eligibility assessments by instantly checking applications against credit policies. This unique feature helps lenders identify eligible borrowers quickly and offers tailored suggestions for ineligible candidates, streamlining the decision-making process and enhancing overall productivity in lending operations.

You may also like: